Reinventing Regular Giving

Description

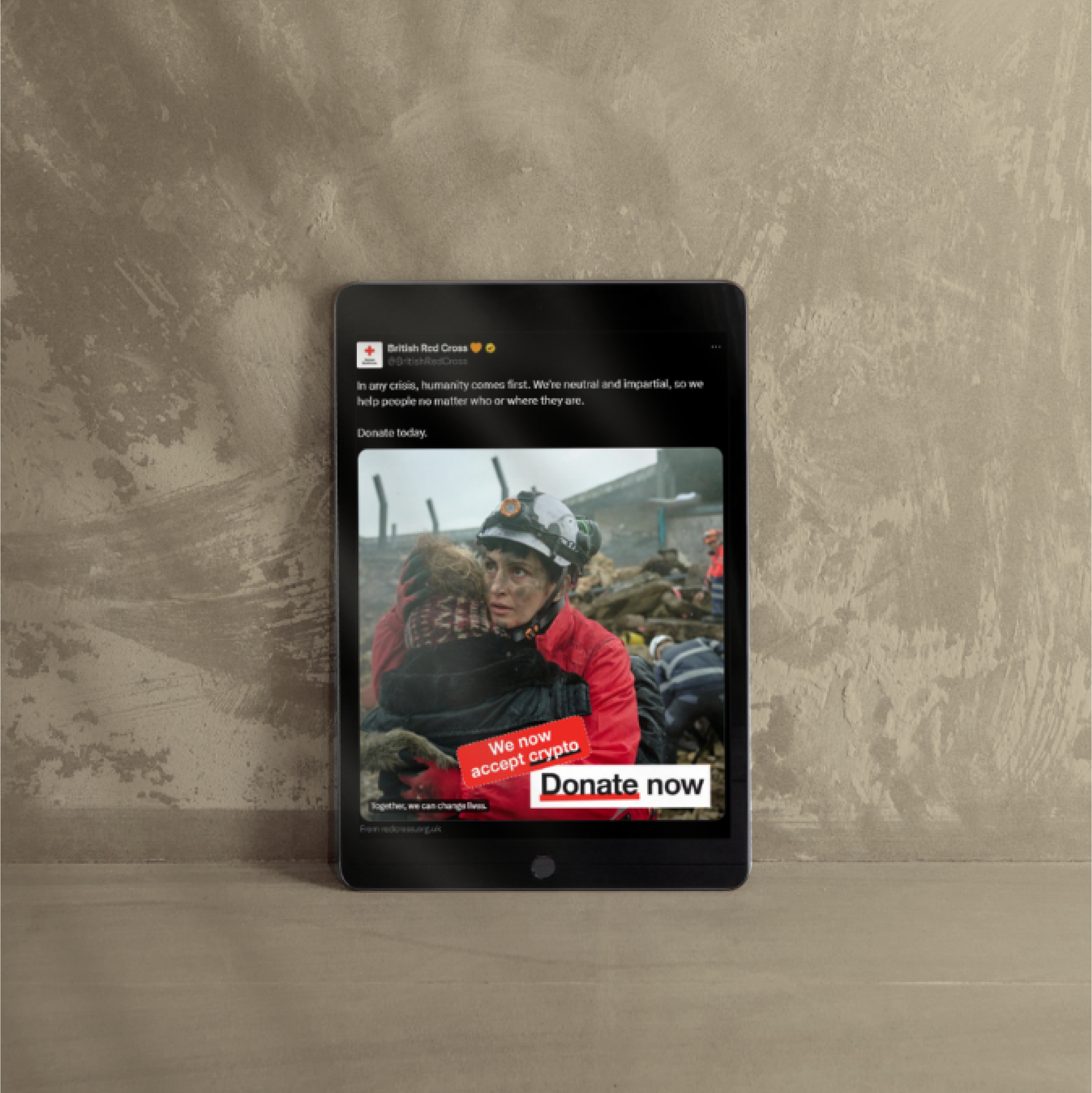

Round-ups is a micro-donations app from the British Red Cross, allowing users to donate spare change from everyday card purchases to the nearest: 10p, 50p or £1. Unlike traditional regular giving models, ‘round-ups’ offers users control, choice and flexibility appealing to evolving financial needs and circumstances.

Information

Brief

Revamp the Regular Giving ModelService

Concept Development, User TestingClient

The British Red CrossField

Micro-donations, Open Banking, AIProduct

Minimum Viable Product (MVP) to Pilot (pre-market)Year

2023Timeline

1 yearTeam size

2–4Challenge

The ‘regular giving’ donor base was in significant decline, dropping almost 50% in the last 10 years, leading to a £3M annual funding gap. The average age of the donor demographic was 58 years old, with little representation amongst 20 - 40 year olds, posing a risk to long-term sustainability of the ‘regular giving,’ fixed monthly donation, direct debit model.

Opportunity

To redefine giving for a younger donor demographic with evolving financial behaviours and needs.

Solution

Leveraging emerging technology and emerging financial products to deliver a new flexible giving proposition, in keeping with expectations of transparency, a superior user experience and choice. The ‘round-up’ donation proposition allows users to give little and often, on their own terms, and collectively make a meaningful impact.

Outcome

Delivering a first to market a product, of its kind. Delivered MVP and Pilot tests, validated with over 200,000 test respondents. Launching in market Q4 2025, £1M estimated raise in year 1.

My Impact

How I pivoted from a declining fundraising model to a new AI powered micro-donation concept. I was initially briefed to create a new membership model. However, months of testing showed limited desirability for this amongst both existing and new donors.

Action:

- Conducted 5Cs situational analysis to review Regular Giving landscape

- Did horizon scanning on emerging financial products and technology

- Identified “round-up” models used by Monzo, Revolut and Chip

- Ran a 4 day design sprint with Open Banking partner, Wonderful Payments

- Iterated the concept to remove Open Banking language and introduce flexible features

- Developed ‘round-ups’ prototype focusing on control, personalisation, and simplicity

Results:

- 10/10 users in Voxpopme testing said they’d use ‘round-ups’ if it was available today

- 80% of 200,000 survey respondents rated the concept highly

I needed to identify the target audience for ‘round-ups’. During the design sprint, recruitment for the prototype test users was a struggle, due to a mismatch between typical Red Cross donors and the younger neo-bank native audience.

Objective:

I needed to identify and reach a relevant audience segment that aligned with both behavioural traits (i.e. used mobile banking) and charitable intent.

Action:

- Analysed donation data from a recent Emergency Appeal

- Identified donors who gave to the British Red Cross via the Monzo app and created a lookalike audience

- Developed donor persona: financially conscious 18–40 y/o users of neo-banks

- Refined testing cohorts based on these characteristics

Results:

- Identified a clear target audience aligned with the proposition

- Supported business case for acquisition of donation app Ripples (£30k)

- Secured internal buy-in for MVP development

The initial Open Banking prototype was too focused on technical infrastructure, confusing users and stalling momentum.

Objective:

To build a user-friendly product that addressed the shortcomings of traditional Direct Debit giving.

Action:

- Led a second Design Sprint focused on flexibility and non technical language

-

Developed user flows allowing:

- Custom round-up thresholds (10p/50p/£1)

- Monthly donation caps

- Appeal-specific donations

- Pause/resume donation controls

- Partnered with Appco (field marketing agency) for in person user testing

Results:

- +89% user approval rating across surveys and interviews

- Demonstrated user need for greater control in giving

- Successfully transitioned Round-ups into MVP stage

The ‘round-ups’ model had no internal precedent, feasibility and ROI needed to be proven before further investment.

Objective:

To build a compelling case for launch by proving desirability, viability, and feasibility.

Action:

- Reviewed data on Revolut’s ‘spare change’ initiative round-up giving model as a benchmark (£109k raised in 6 months through 5,000 donors)

- Combined this with strong user test results

- Developed a business case with projected revenue and acquisition goals

- Round-ups approved for launch with £1m media budget

- Fundraising target set at £1m in revenue by end of 2025

- Product positioned as the future of Regular Giving